I- SAVINGS CALCULATOR : based on your personal savings projection

II- EXAMPLE OF THE LONG-TERM INVESTMENT OF YOUR RETIREMENT CAPITAL

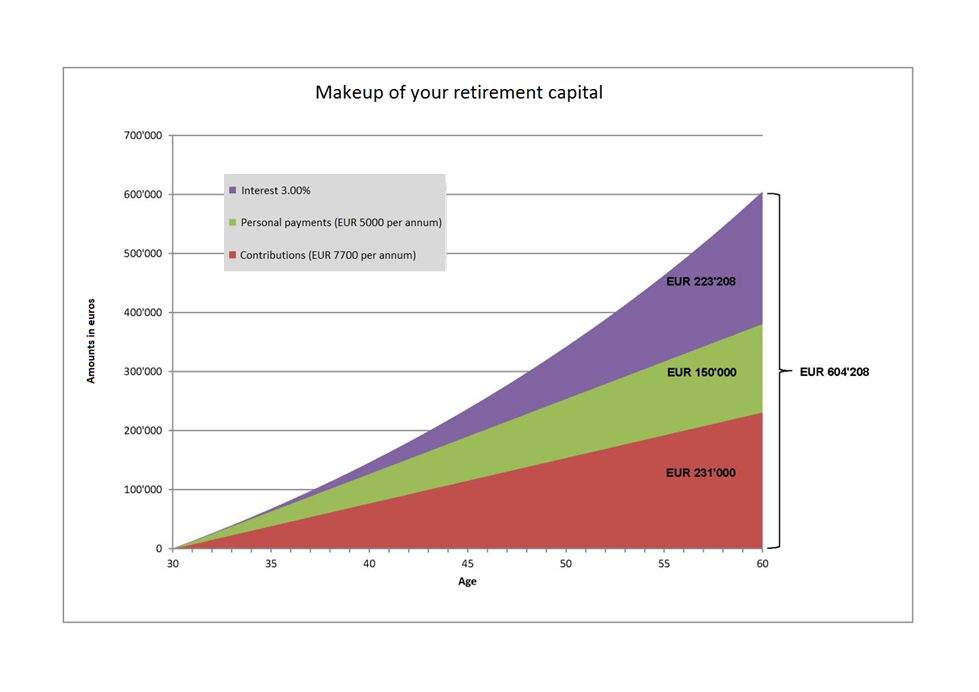

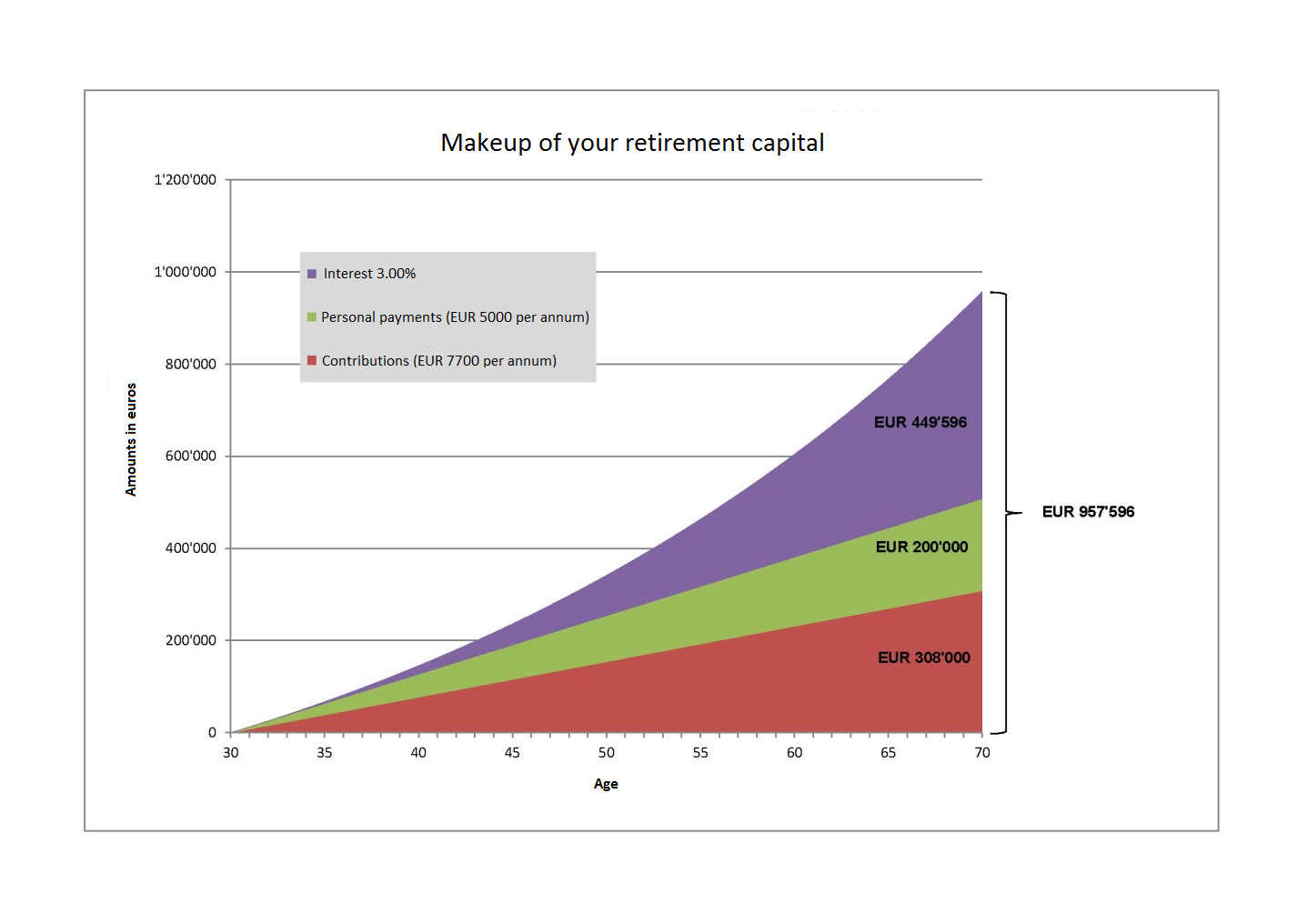

The two diagrams below illustrate how the regular input of contributions and/or the regular transfer of personal payments to your CPIC account contribute to the production of compound interest in the long term.

For both diagrams, the underlying hypotheses, which are derived from an actuarial study into CPIC over the period from 2006 to 2015, are the following:

- mean age when joining CPIC: 30, without an initial capital injection;

- mean level of annual contributions: EUR 7700;

- mean level of annual personal payments: EUR 5000;

- withdrawal from CPIC at the age of 60 or 70;

- mean interest rate taking the period in its entirety: 3%.

The hypothesis of an interest rate of 3% corresponds to the ten-year return expectation envisaged by our portfolio managers; CPIC’s historic performance for the euro growth segment (Segment A) has, by contrast, been higher than 5% per annum (https://www.cpic.ch/gestion-financiere/performance-part-a/).

Reminder regarding personal payments:

The amount and frequency of personal payments are entirely a matter of choice for the beneficiaries.

The Foundation Council has fixed a maximum annual limit of € 46 000.- or CHF 46 000.- for voluntary payments.

These payments may be made by bank or postal transfer or by cheque. Details are to be found on our website. Please use the following link: